Zovem se Minela i imam 36 godina. Rođena sam i živim u Tuzli, gradu koji je nekada...

Stanislava ima 38 godina i već godinama živi i radi u Njemačkoj. Stabilna je, organizovana i naučila...

Albanka Zoge rodila je troje dece svom suprugu Radosavu iz Gornjeg Ojkovca. Sve je više Srba, posebno...

Moje ime je Mirsada, imam 36 godina i već godinama živim u Beču — gradu koji ti...

Albanke traže ozbiljne muškarce za brak – upoznavanje preko Vibera ili Messengera Ako ste ozbiljan muškarac koji...

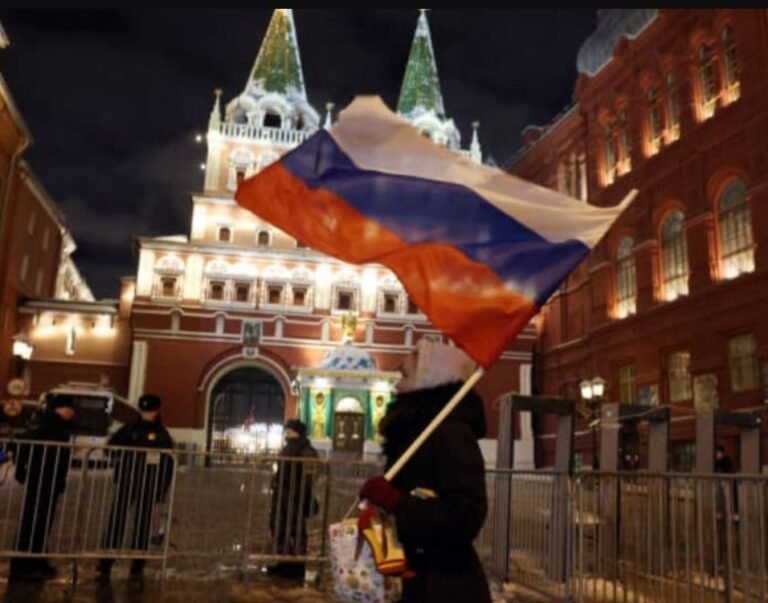

Brakovi između ruskih žena i srpskih muškaraca postaju sve češća tema u poslednje vreme. Ovo nije iznenađujuće,...

Ruskinje traže ljubav, ne penziju – provodadžijka iz Moskve otkriva istinu o upoznavanju Srba i Ruskinja Natalija...

Nina, 34-godišnja žena iz Novog Sada, dugo je birala trenutak da konačno napiše ono što joj je...

“Sarajevska Ljepotica Otkriva Istinu Koju Niko Ne Očekuje — I Traži Muškarca Koji Može Da Je Isprati!”...

Roza Popadić, Albančica iz Skadra, pre više od deset godina došla je u selo Buđevo i udala...